Calculating cost of borrowing

Advertisement Step 1 Compare the payment tables for the two illustrations. Calculation results are approximations and for information purposes only.

Excel Formula Calculate Payment For A Loan Exceljet

Figure out your Finances today.

. Here are the top five you should look out for. Use the slider to set the. Or more specifically a prepaid finance charge.

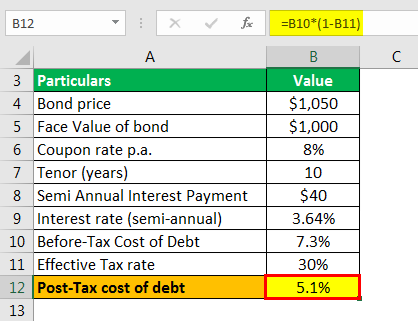

Opens new window Select the term for your loan. If the effective tax rate on all of your debts is 53 and your tax rate is 30 then the after-tax cost of debt will be. Explore our loan calculators and other tools to estimate your payments see the cost savings of a particular borrowing strategy and more.

Deep Historical Options Data with complete OPRA Coverage. The cost of borrowing will change depending on the type of loan product youre borrowing. 55 APR Representative based on a loan of 10000 repayable over 60 months at an interest rate of 55 pa fixed.

W4 Weighted Average Borrowing Cost Rate. Even if the difference in interest rate is only half a percentage point the cost of borrowing the extra increment is often significantly higher. The cost of borrowing varies depending on the type of loan you take out so its important to ask about the total interest and fees or extra charges.

There are plenty of factors that come into play when calculating the cost of borrowing. Interest rate is the amount charged by lenders to borrowers for the use of money expressed as a percentage of the principal or original amount borrowed. Service website has a mortgage calculator and mortgage affordability.

Even a small change can have a big impact. Ad Rich options pricing data and highest quality analytics for institutional use. 53 x 1 - 030 53 x 070 371.

How to calculate loan payments and costs 7 min read. Total amount payable 1142340. Calculations assume that the interest rate will remain constant over the entire amortizationrepayment.

There are plenty of factors that come into play when calculating the cost of borrowing. Required Calculate the eligible borrowing cost that will be capitalized as part of the cost of the office building and the finance cost that should be reported in profit or loss for the year ended 31 December 2013. Click Now Apply Online.

To Use the online Loan Calculator 1 simply. Annual percentage rate or APR is the total cost of borrowing from a financial institution over one year. These fees are usually considered part of the finance charge.

Type into the personal loan calculator the Loan Amount you wish to borrow. Our quick and easy Debt Consolidation calculator can show you the potential cost savings of consolidating some or all of your debts into a new loan. If APR were a puzzle it would have many pieces.

Analytic and Tick Data. Rates quoted are not considered rate guarantees. Choose a borrowing solution thats right for you.

Use the personal loan calculator to find out your monthly payment and total cost of borrowing. Draw funds from you line of credit whenever you need it and whatever you need it for. Get Instantly Matched with the Best Personal Loan Option for You.

Input the Annual interest rate for the loan. W5Cost of the Asset at 31122013 250002000015000 6545 66545. Our Personal Loan Calculator tool helps you see what your monthly payments and total costs will look like over the lifetime of the loan.

To do the cost of borrowing calculation using the discount module the total costs of 2500 is entered into the yellow input box by first clicking on the radio dial then clicking on the Click to Calculate button. Number of months to repay your loan. Type of loan product.

It can also be described alternatively as the cost to borrow money. We calculate the monthly payment taking into account the loan amount interest rate and loan term. Interest is accrued daily and charged as per the payment frequency.

Calculating the incremental borrowing cost allows you to weigh your financing options more clearly. Enter the amount into the box. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

Ad Homeownership Gives you Financial Options. Annual percentage rate is a good way to calculate the cost of borrowing because it takes into account all associated costs of borrowing including extra charges like late fees closing fees and administrative fees. Your companys after-tax cost of debt is 371.

Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. See If You Qualify Today. This will show you how the interest rate affects your borrowing or saving.

Find the difference in borrowed amount by subtracting the lesser borrowed amount from the higher borrowed amount listed on the illustrations. W4 Weighted Average Borrowing Cost Rate. To comply with the new Ontario legislation January 1 2009 the cost of borrowing is 66313.

For example if the lender assesses a fee of 5 and the loan amount is 250000 the fee will be 12500 and you will receive 237500. How APR the cost of borrowing is calculated. You must however pay back 250000 to the lender.

Other charges to be aware of include late. Calculating the incremental borrowing cost allows you to weigh your financing options. Along with the amount of your loan your interest rate is extremely important when it comes to figuring out the total cost of borrowing.

For instance an 8 interest rate for borrowing 100 a year will obligate a person to pay 108 at year-end. Choose how much you want to save or borrow. How to use our calculator.

The interest cost over 25 years in 50053. Monthly repayment of 19039. MoneySuperMarkets loan calculator is designed to give you an idea how much a personal loan is going to cost.

To Use the online Loan Calculator 1. Calculating after-tax cost of debt. Ad Apply and if approved have funding thats there for your business.

Enjoy No Prepayment Penalties with Optional Discounts. Lets take the example from the previous section. Skip the Bank Save.

The frequency of repayments for.

Here S A Quick Guide To Knowing The Magic Of Compound Interest In 2022 Compound Interest Simple Interest Loan Calculator

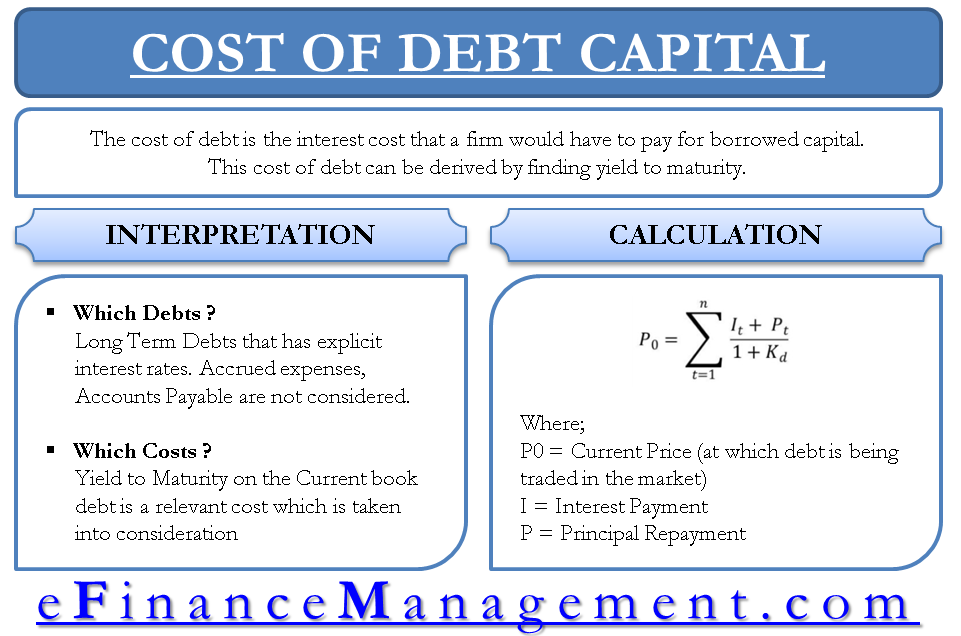

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc

Cost Of Debt Kd Formula And Calculator Excel Template

Financing Fees Deferred Capitalized And Amortized Types

Borrowing Base What It Is How To Calculate It

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Cost Of Debt Capital For Evaluating New Projects Yield To Maturity In 2022 Accounting Basics Accounting Books Accounting And Finance

Pin By Sh Investments On Random Mortgage Online Mortgage Real Estate Information

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

Cost Of Debt Kd Formula And Calculator Excel Template

Understand The Total Cost Of Borrowing Wells Fargo

Cost Of Debt Kd Formula And Calculator Excel Template

Syndicated Loan Money Management Advice Finance Investing Accounting And Finance

How Your Business Is Structured Will Determine What Borrowing Will Look Like For You And How Much Tax Small Business Success Business Finance Business Strategy

Pin On Business News

Cost Of Debt Kd Formula And Calculator Excel Template

Cost Of Debt Should Be Interest Cost On Capital Yield To Maturity Efm